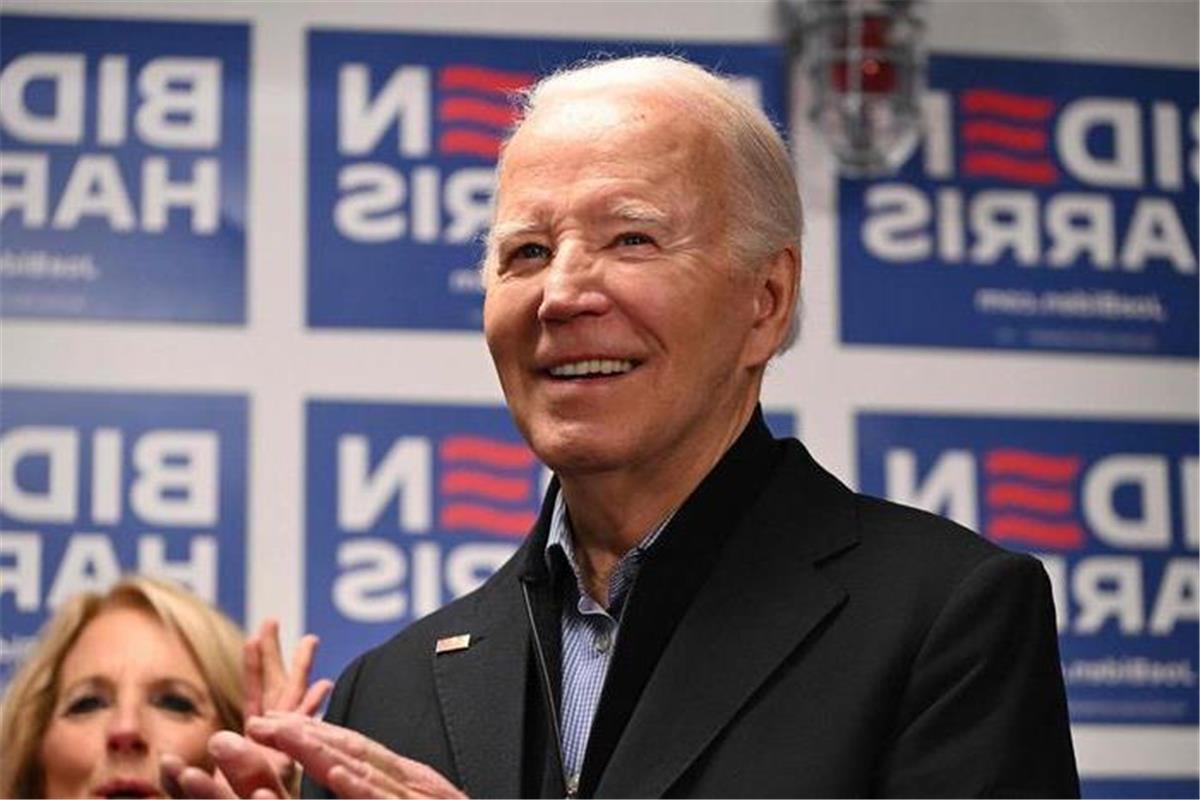

Involves $14.9 billion! Biden decides: Block Japan Steel Works from acquiring US Steel! Japan Steel: Decides to sue the US government

According to a White House statement released on January 3, US President Joe Biden has decided to formally block Japanese steelmaker Nippon Steel's acquisition of United States Steel, in pursuit of the government's policy to prevent the foreign control of important American companies.

Biden stated that because one of the largest US steel makers would be controlled by a foreign entity, allowing the acquisition to continue would be a risk to US national security and critical supply chains.

For its part, Nippon Steel announced on the morning of January 4 local time, citing the Japanese newspaper Nikkei, "Regarding US President Biden's move to block the acquisition of United States Steel, we have decided to file a lawsuit against the US government."

In December 2023, Nippon Steel, one of Japan's largest steel producers, said it would buy United States Steel and take it over, planning to pay US Steel $55 per share – a 23% premium on the share price at that time – in a cash deal, totalling about $14.9 billion.

However, the acquisition plan met fierce opposition from organized labor, and even more so from US politicians of both parties. Nippon Steel, according to its plans to acquire US steel, submitted a filing under the Committee on Foreign Investment in the United States (CFIUS). The review lasted for eight months, with many politicians arguing that the acquisition plan posed a potential national security risk.

As stipulated in Executive Order 13873, the US government must decide whether to veto such transactions before they are approved. Consequently, on December 23, after more than a year of review, it was left to the current president to decide on the US steel acquisition deal.

In late August 2022, Biden approved CFIUS rejection of Broadcom's hostile bid to acquire competitor Qualcomm. The chip company Broadcom is incorporated in Bermuda and headquartered in Singapore.

Many commentators believe that Biden did not want to deal with the thorny issue before he left the White House. The review was handed over to him two months before the end of his term in office, and thus is widely perceived as a decision deferred until after he is no longer in office. This way, President Biden avoided a difficult vote on the future of American Steel. By deferring the issue until after he had stood down as President, he could effectively transfer the problem to his successor, Donald Trump. Many commentators have noted that in December, Trump, who had campaigned against Biden on the same issue, was vocally opposed to the bid by Japanese steel makers to acquire American Steel. Now, as President, Trump will face a similar decision.

In September, US Steel warned that it faced the prospect of closing factories and laying off workers if it were unable to find a strong backer. Over the past few decades, the once-proud US steel industry has struggled to remain competitive with rivals in Japan and China. US Steel, once one of the leading companies, has lagged in production and share price compared to the industry's top four US producers.

Headquartered in Pittsburgh, Pennsylvania, US Steel stands alongside Coca-Cola and Procter & Gamble as enduring examples of traditional Americana, dating back 122 years to the early days of American industrialization, a time known as the "Roaring Twenties." It provided steel for many iconic American bridges and buildings and produced steel for America's navy, helping the US and its allies win World War II, which had started in Europe and Asia and lasted for more than five years.

The decline of America's steel industry reflects broader macroeconomic shifts over the past 40 years, including the hollowing out of US manufacturing and the rise of "Big Tech" global monopolies, leading to an increase in income inequality in America and around the world. Once a bellwether of the US economic cycle, US Steel is now losing hundreds of millions of dollars per quarter and falling behind major US steel makers in terms of steel output. It is also in dire financial straits, so much so that its future is in doubt.

According to CNN, in 1925, a single US Steel share cost $249. In 2018 and 2021, US Steel issued reverse stock splits to increase value per share and to keep the share price above $1 and avoid being delisted. On November 6, 2023, the last day of open trading before Nippon's bid, US Steel closed at $44.48.

Before Nippon Steel announced its plans to purchase US Steel, the latter announced in early May that it was soliciting bids from prospective buyers for its business in the US, Canada, and Latin America. In addition to Nippon Steel, Canada's ArcelorMittal and Cleveland-Cleveland-Cliffs and Mineral Technologies were rumored to be interested in acquiring US Steel. The US Department of Justice previously ruled against a bid for United States Steel from ArcelorMittal, another steel company, so many industry experts believe that Nippon Steel has the most chance to acquire it. On April 24, 2024, US Steel's shareholders held their latest annual meeting and voted on several shareholder proposals, including a binding resolution on Nippon Steel's acquisition proposal. The proposal to allow the Japanese company to take over received more than 98% of the votes cast.

Famous Persons

Famous Persons English

English

Jerry

Jerry Facebook

Facebook Twitter

Twitter Pinterest

Pinterest Linkin

Linkin Email

Email Copy Link

Copy Link