Japanese Steel is angry: Sues the US government!

According to sources close to the matter, Nippon Steel Corp. is considering filing a lawsuit against the US government in response to its blocked acquisition of US Steel. The main concerns that Nippon Steel is expected to raise in the lawsuit include whether the Committee on Foreign Investment in the United States (CFIUS) followed appropriate procedures in reviewing the deal.

If the acquisition indeed fails, Nippon will have to pay US Steel a default fee of $565 million.

In December 2023, Nippon announced its plan to acquire US Steel Corp. for $14.9 billion dollars. However, the proposed acquisition was met with strong opposition from the United Steelworkers union as well as lawmakers from both major US political parties.

US President Joe Biden officially blocked the Japanese steelmaker's bid to acquire US Steel on January 3.

Related stories:

From concessions to 'fatal blow'

According to a White House statement, Biden said that if the deal gets the green light, one of the largest US steel producers will be controlled by a foreign entity, which would pose a risk to America's national security and key supply chains.

But Biden did not specifically say how the deal would harm US national security.

Following Biden's announcement, Nippon and U.S. Steel released a statement denouncing the decision, stating that Biden's move "reflects profound violations of due process and the law" and that it is "shocking and deeply disturbing that an ally of the US such as Japan would be treated in this fashion."

In an effort to salvage the deal, Nippon agreed to a number of concessions. Nippon repeatedly sent its top management, including Deputy Chairman and Executive Vice President Takahiro Mori, to the US for "lobbying" purposes. They promised to invest an additional $2.7 billion after completing the acquisition of US Steel, form a board of directors with a US majority, and even went so far as to offer the US government a veto over production adjustments. But all to no avail.

Resistance only from 'allies'

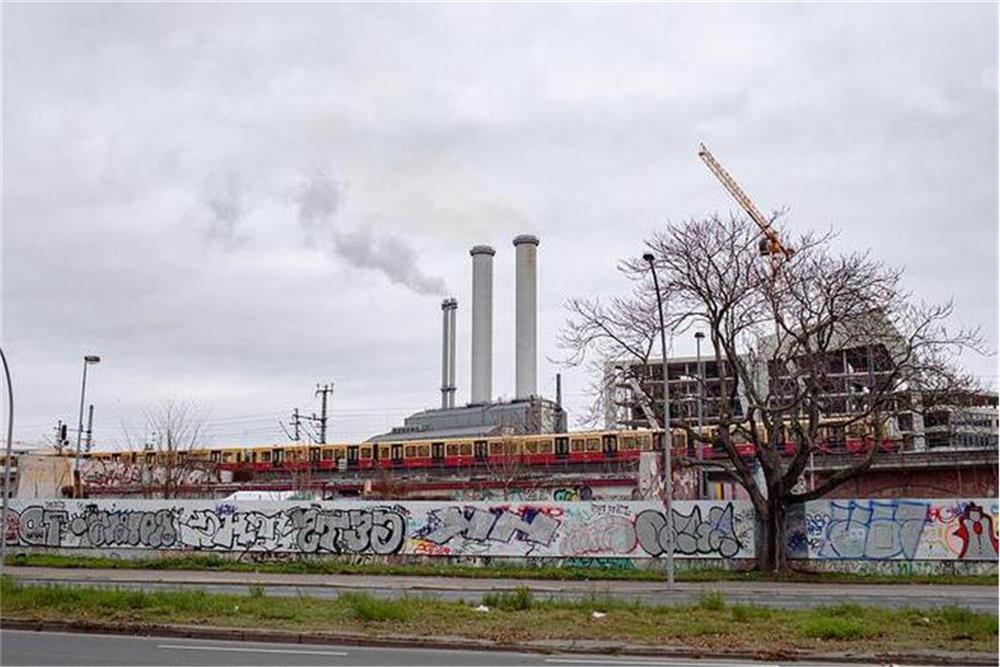

US Steel Corp. was founded in 1901 in Pittsburgh, Pennsylvania. During the 20th century, as the US underwent rapid industrialization, US Steel was considered a traditional pillar of American industry, a "backbone" for Americans.

But times change. In recent years, US Steel has consistently operated at a loss. When it comes to steel production or even stock price, US Steel is miles behind other American steel companies, so it turned to the market and announced that it would sell itself.

Nippon announced its intentions to acquire US Steel in December 2023 for $14.9 billion, but the deal immediately faced strong opposition from the United Steelworkers union and politicians from both major US parties.

In April 2024, US Steel held a special shareholders meeting to pass the plan for Nippon to take it over. In September, the CFIUS, which is responsible for examining foreign investments, said that it had "security concerns" with the plan.

Pennsylvania is one of the key "swing states" in the 2024 US presidential election. Both Biden and Donald Trump need to cater to the voters in Pennsylvania, so they were united in opposing the takeover of US Steel by a Japanese company.

The only one affected is the blue-collar worker

Despite the US government's insistence on the danger of the acquisition, whether the acquisition actually does greater harm than good, or vice versa, the people involved are most qualified to judge.

In September 2024, US Steel's employees gathered in front of the company's central office in downtown Pittsburgh to demand that the acquisition be concluded.

US Steel has warned that if the deal fails, it will transfer production from blast furnaces to cheaper electric arc furnaces and move its headquarters out of Pittsburgh as well, meaning thousands of jobs will be carried away.

It was once a giant in America's steel industry, but now it is on life support. According to the World Steel Association, in 2023, Nippon Steel ranked fourth in crude steel output globally, while US Steel ranked 24th.

After Biden announced the prohibition of the merger on January 3, the New York Stock Exchange showed that the US Steel stock price plunged nearly 6% that day, closing at $30.66 per share.

America itself cannot bring back its manufacturing sector, and it does not allow acquisitions of US companies by foreign entities, so in the end, who suffers the most? It's the blue-collar workers.

Failed acquisition, $500 million fine

Nippon plans to increase its global capacity from 65 million tons per year to 85 million tons after taking over US Steel, bringing it close to its long-term target of reaching a capacity of 100 million tons. With the failure of the acquisition, Nippon will have to pay a penalty to US Steel of $565 million, which will make it rethink its overseas-focused growth strategy.

Japanese side: America's problem of overweening vanity

Some Japanese people believe that America is wrong for trying to stop the acquisition, and that this is just another example of America putting its own political interests first at the expense of its ties with Japan.

Nakanemaru Junichiro, a professor at the School of Law of Tokyo University and a former senior director of the Japanese Ministry of Finance's Financial System Council, said that for America, this is a problem of overweening vanity; Japan has repeatedly stated that US Steel's employees will get a pay raise and other benefits if the deal goes through.

"What the Japanese government said in this deal was basically right. I believe this is just an example of Americans overestimating their own capabilities," Nakanemaru said.

Hidetoshi Tayama, chief economist of Japan's Gendai Kyotaku Co., said the whole affair is "completely" the result of politics. Japanese companies naturally want to expand in the US market, but if they are harassed afterwards, it is a waste of time, so the enthusiasm of Japanese companies to expand in the US market, at least right now, is very low.

Tayama said Japan alone cannot combat US protectionism in the semiconductor sector and the auto sector, so Japan has withdrawn from America's market in these sectors and focused instead on cooperating with China. And it's not unreasonable to think that if the situation continues to deteriorate, even Japanese companies that are already in the US market will quietly pull out. So, in this sense, it is eroding US-Japan economic relations at the level of individual companies, which is also the most fundamental level.

Biden's move went against America's long-held culture of openness to investment and could have far-reaching implications for US economy.

But in America's so-called open investment culture, the US has repeatedly used the excuse of national security to block other countries from investing in, or expanding their manufacturing in, America. The contradictions between the US and Japan over this issue go back to the last century. In the 1980s and 1990s, as the Japanese auto industry grew and quickly caught up with the US industry, the US government and America's car companies started to get nervous and took multiple actions to pressure the Japanese.

Matthew Slaughter, Dean of Tuck School of Business at Dartmouth College, said that for decades, America's engagement with the global economy was "very much" driven by large foreign companies like Nippon Steel, which had been a "huge net" plus in strengthening the country's economic strength and vitality.

"But now we have this huge contradiction – to find new enemies everywhere and build new walls. We should find mechanisms to deal with that, rather than just building more and more walls and not understanding the basic nature of globalization," he said.

America's fading "backbone" industry is struggling to stay afloat, and its "ally's" hopes of taking over and turning things around have been smashed. So, can America's wounded pride really sustain its steel industry?

Famous Persons

Famous Persons English

English

Sini

Sini Facebook

Facebook Twitter

Twitter Pinterest

Pinterest Linkin

Linkin Email

Email Copy Link

Copy Link