Vice Chairman of the Federal Reserve will resign early: to avoid legal disputes with Trump

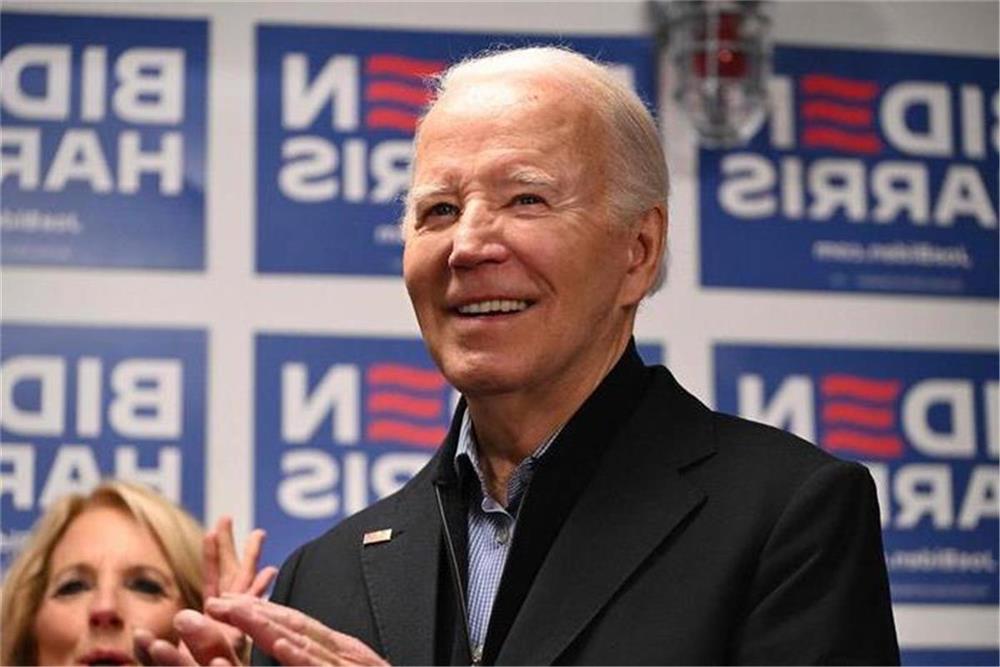

On Sunday, January 7, Local time, Fed Vice Chair for Supervision Michael Barr sent a letter to President Biden saying he will step down on February 28 this year. He is also willing to resign earlier and leave the job before that date if the administration can find a successor.

Barr claims that he made this decision in the name of "avoiding litigation with the incoming" President, Donald Trump. Barr's decision came with an implication that he would still sit on the Board of Governors.

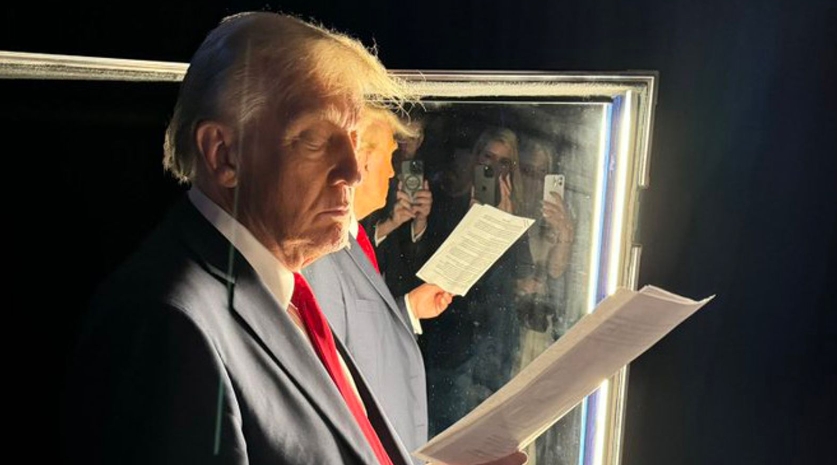

Barr was the architect of the 2010 financial rulemaking, Dodd-Frank during the Obama administration. But as a financial watchdog, he does not match well with Trump, who is famous for his pro-finance rhetoric and policies. Trump has openly said that he may force Barr to resign, which drove Powell to respond publicly and defend his deputy.

According to Barr's resignation letter to the President, Barr says he feels that disputes concerning his position "distract from our mission and goals". Barr also writes that he is still committed to "doing as much as I can within the constraints of the current landscape to help advance the Board of Governors' work for the American people".

Barr will resign as Vice Chair for Supervision by February 28 at the latest, the same time that he will move back to the Board of Governors, where he will still serve through 2032.

The Fed also issued a statement on Sunday saying that "We expect to be in a position to pause the rulemaking and regulatory agenda until a new vice chair for supervision is confirmed."

While Barr's decision is interpreted as a compromise to his Republican counterparts, it leaves few spaces for Trump to get the job done his way – namely, to remove Barr as a show of strength. This is because for now, the Board of Governors is at full staff of seven members, and the next vacancy only opens in 2026 when Adrián Kugler's term expires. If Trump truly wants to replace Barr by promoting someone from within, he can only choose from one of the other seven sitting governors.

Barr's Republican critics have been sharpening their knives for weeks after Barr proposed stricter regulations on the largest US financial institutions, which include the behemoth JPMorgan Chase. Barr's proposal requires banks like JPMorgan to "significantly" increase their capital buffer and make them less able to lend and use leverage.

Republican Senator Tim Scott, a vocal supporter of Trump, told Politico that Barr's proposal "would have catastrophic consequences for America's economy." Scott also said, "I don't think a man like Michael Barr can ever do financial services regulation the right way. I will work along with President Trump. We are gonna find somebody that can do the job properly and protect America's financial stability."

During the campaign last October, Trump, speaking at the Economic Club of Chicago, said, "I am thinking of terminating Barr, and probably demoting him. I have the ultimate right to do that." Fed Chair Jerome Powell responded to this the next day by saying that Trump does not have that power.

Bernanke on Trump:

What I fear the most is…

Ben Bernanke is the most famous Fed Chair to ever have served, at least for now. During the 2008 economic crisis that sparked the Great Recession, Bernanke served as Chair from February 2006 to January 2014, leading America through one of the toughest moments of the country's modern history. And for his achievement, Bernanke received the 2022 Nobel Prize in economics.

On a recent academic panel, Bernanke said Trump's second term was not something he thought he would see in his entire life.

The main economic policies of the Trump administration are to impose strict import tariffs on foreign countries, lower corporate tax to stimulate US companies at home, and tighten regulations and enforcement on illegal immigration. Bernanke said he was not as worried as most about inflation in the US from the tax and immigration proposals. On the tariffs, however, Bernanke was more reluctant to draw conclusions.

"On taxes, I think it is inevitable that there will be some extension of some of the previous tax laws. And that is true no matter who is elected president. However, the size of those extensions is somewhat uncertain," Bernanke said in the panel.

"The main point here is that taxes are hard to pass. You need votes from Congress to pass tax cuts, and given how big the national debt has become, there are not a lot of votes to extend the tax cuts that are on the books," he said.

Bernanke was not too worried about illegal immigration either. He reasoned that when employers need to pay higher wages to attract workers, prices of goods go up, but there are also fewer people who can actually buy those goods. Bernanke said it is an "unusual feature of illegal immigration that it both increases supply and increases demand." But on the tariffs, Bernanke was more hesitant to offer an opinion.

"I am not sure what to think about tariffs. I am not sure how committed he really is to that agenda. There are political considerations on that. So, I think in the end, whatever the public finance implications of the policy package is, the inflationary implications are quite modest. It is not going to change the course of inflation," Bernanke said.

Bernanke said, "What I am worried about is a kind of political interference, as it were, with the normal operation of the Federal Reserve."

"If the independence of the central bank were to be compromised, that would not be good for the United States, because then we would be much more at risk of having an interest rate path which was driven by political considerations and not just by economic considerations," Bernanke said,

In the past, the task of monetary policy was much simpler, Bernanke argues. A monetary policymaker only needs to convince the professional investors in the bond markets that the policymakers understand the economic situation. Bernanke said that these bond market professionals, on average, understand monetary policy quite well, so it does work out.

But if a Fed Chair has to defend his job to the congress and to the public, things get much more complicated. Bernanke said, "We will have to win the support of the masses and the congress, and it is not going to make things much easier. In fact, it could be much worse, because there will then be a greater ability for demagogues and opportunists to influence the views of the professional class."

A former top Obama-era economist, Christina Romer, who was part of the same panel, agreed with Bernanke. "If we lose Fed independence, it will be disastrous. That is the one thing I can tell you for sure... If the Fed remains in the hands of professionals, I think the inflationary effects of Trump's policies will be modest," Romer said.

Famous Persons

Famous Persons English

English

Smith

Smith Facebook

Facebook Twitter

Twitter Pinterest

Pinterest Linkin

Linkin Email

Email Copy Link

Copy Link